Benefits of CRM in Banking Industry

CRM for banking systems make everyday tasks easier and help you make better decisions. Banking CRM Systems provide clear insights into customer needs and help manage risks effectively.

Enhanced Decision Making

Efficient Risk Management

Improved Customer Insights

Hassle Free Collaboration

Why CRM is crucial for the Banking Industry?

CRM software for banks enhances customer interactions and service. Our Retail Banking Software streamlines retail banking for better engagement and growth.

Banking CRM Customer Relationship Enhancement

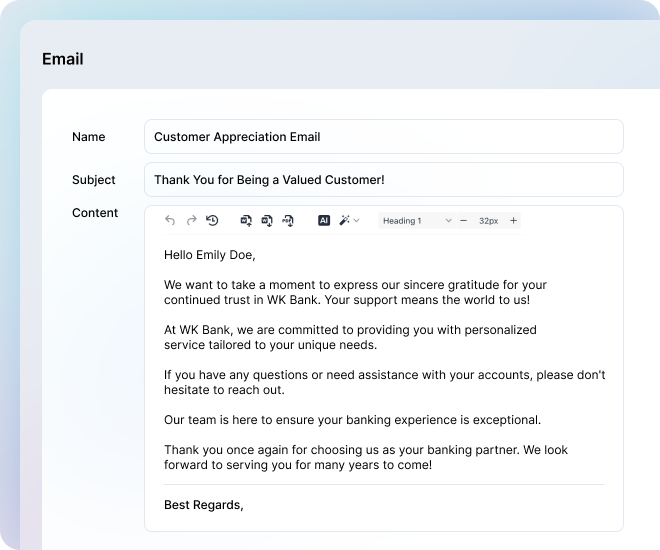

Personalized Communication

Customize your interactions to each customer’s needs with Krayin Banking CRM Software. By customizing you build stronger relationships with your clients.

Loyalty Programs

Create rewards systems to keep your clients happy. Krayin CRM for banking Software helps you set up and manage loyalty programs, making it easier to keep customers and encourage their long term loyalty.

Feedback Integration

You can creates feedback or any other form with the help of custom webforms. This collects and analyzes feedback, enabling you to continuously improve to meet your clients’ needs.

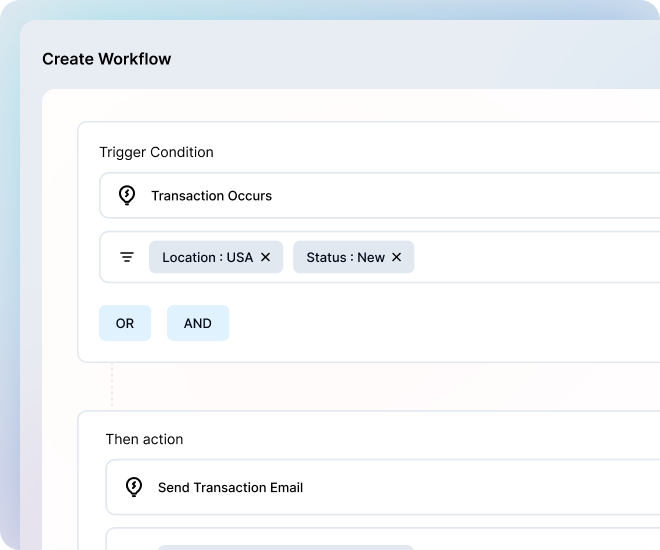

Optimized Workflow and Automation for Banking CRM

Workflow Automation

Automate routine tasks to decrease manual work. This helps you focus more on important banking activities and reduces errors.

Resource Optimization

Krayin Banking CRM Software helps you optimize most of your resources. Retail Banking Software lets you track and manage staff tasks, divide work efficiently, and use your resources where it is required.

Easy Processes

Make your operations simpler and faster. This leads to quicker service delivery and a smoother experience.

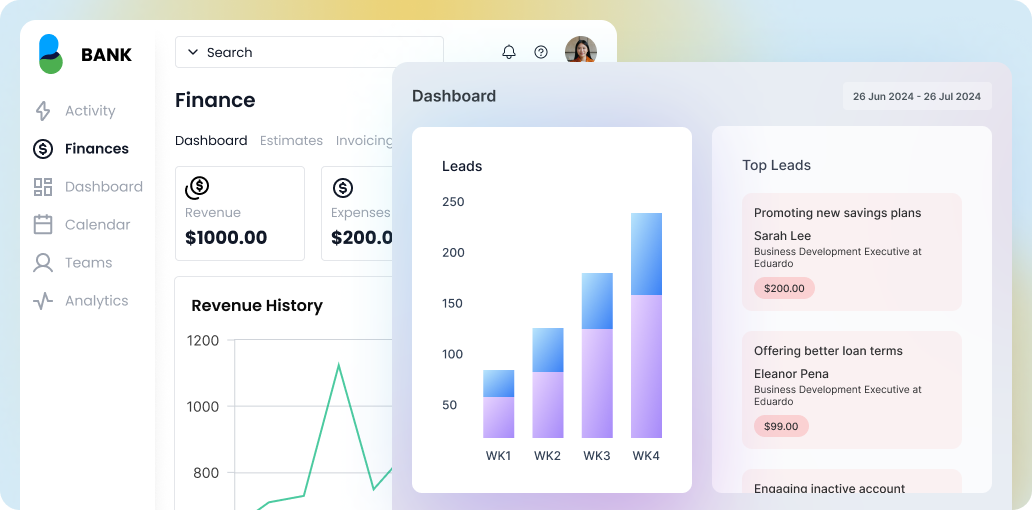

Banking CRM Sales and Marketing Integration

Unified Strategies

Krayin CRM software for banks connects your sales and marketing activities, so you can send consistent messages and engage customers.

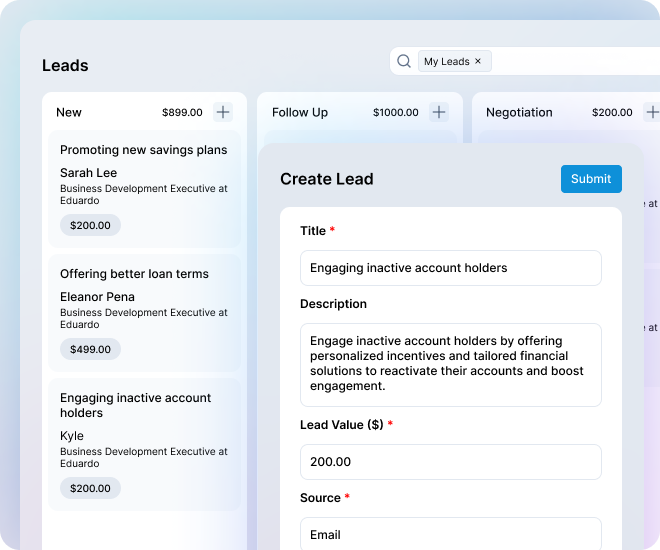

Targeted Campaigns

With Krayin CRM software for banks, you can create focused marketing campaigns by using detailed customer profiles to reach the right people.

Lead Development

Krayin Banking CRM Software helps you to create new leads and automate follow ups, making it easier to build strong relationships and increase sales.

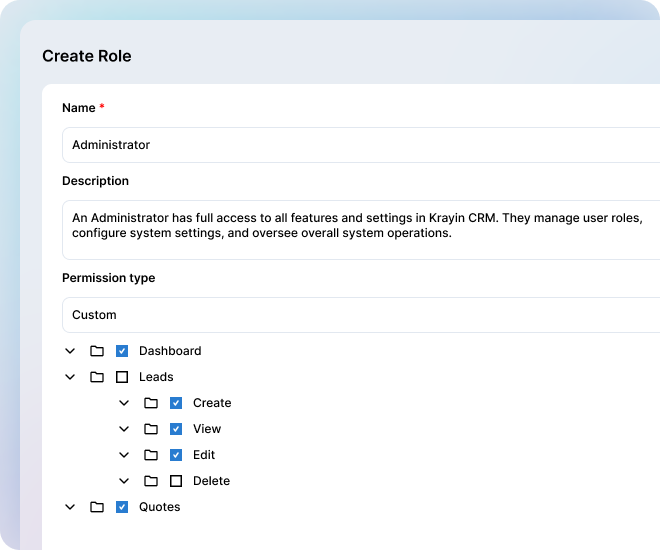

Data Security and Compliance for Banking CRM

Secure Protection

Krayin Banking CRM Software uses advanced security measures, including Access Control List (ACL), to ensure precise management of user permissions and safeguard sensitive data.

Regulatory Compliance

Banking CRM Systems helps you follow industry rules and standards, ensuring you stay compliant and maintain customer trust.

Risk Management

Krayin CRM helps you spot and manage risks early, protecting against data breaches and fraud.

Begin your Banking journey with Krayin CRM

Download and Install

Data Migration

Customize your CRM

Integrate with Existing Systems

Documentation and Resources

Monitor and Optimize

Why choose Krayin CRM for Banking?

Krayin CRM software for banks Software is designed to address the special needs of the banking sector with a range of powerful features. Banking CRM Systems helps banks streamline their operations, enhance customer relationships, and make data driven decisions.

Powerful Sales Management

Seamless Integration Capabilities

Advanced Customer Support

Powerful Data and Analytics

Resource Optimization

Customizable Reporting

Banking CRM Software FAQ

Krayin CRM uses strong encryption and security measures to keep your data safe. It also ensures compliance with industry standards.

Yes, Krayin CRM easily connects with your current software, making it simple to streamline your operations.

Krayin CRM makes managing loans easier. It tracks applications, automates approvals, and keeps in touch with clients.

Banks can deliver exceptional customer experiences with the help of Krayin CRM. To make dealings more effective and smoother, it offers personalized services and effective support channels.

Want to improve your sales?

We are ready to work and build on-demand CRM Solutions for your business.